Direct answer (for CFOs who don’t have time)

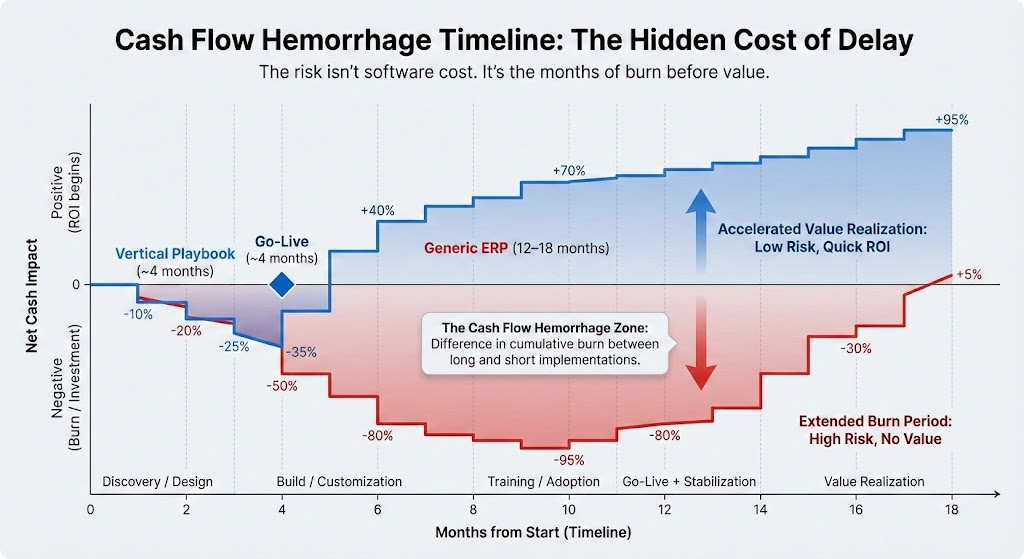

ERP implementation for manufacturers is failing in volatile markets—not because the software is weak, but because generic implementations create a long negative cash window before value. Generic ERP implementations fail in volatile markets because they’re designed for stable assumptions—stable lead times, stable capacity, stable adoption. In emerging-market manufacturing, those assumptions break fast. The result is predictable: spreadsheet planning, wrong MRP signals, costly customization, and 12–18 months of cash burn before value. Pentagon’s vertical playbook approach compresses implementation timelines and reduces adoption failure by deploying repeatable, industry-specific workflows with operator-led execution—not generalist consulting.

The industrial existential crisis of 2026

In 2024, efficiency was a metric. In 2026, it’s a survival requirement.

Across South Asia, East Africa, and APAC, “normal” operations are gone. Tariff shocks, inflation in raw materials, and fragmented supply chains have turned forecasting into firefighting.

Here’s the part most boards miss:

The biggest threat isn’t volatility outside your factory.

It’s the cash leak inside your transformation program.

Pentagon calls this the cash flow hemorrhage—the slow drain that happens when you commit to a long, generic ERP implementation that can’t match how manufacturing actually runs in unstable markets.

The hidden enemy: cash burn without operational gain

A long ERP implementation creates a brutal financial pattern:

- Consulting fees stack monthly

- Your best people get pulled into workshops

- Production planning shifts into workarounds

- Adoption resistance grows with every delay

- The business pays twice: once for software, once for shadow systems

Pentagon’s positioning is blunt for a reason:

ERP doesn’t fail in manufacturing. Implementations do.

If you’re a CFO staring at a 14-month timeline, you’re not looking at “digital transformation.”

You’re looking at extended negative cash flow with uncertain adoption.

Voice of the Customer: what your team is Googling in panic

We don’t need guesswork to understand what’s breaking.

The search behavior from manufacturing teams in this region is consistent: operators and managers aren’t searching for “ERP innovation.” They’re searching for ways to stop operational bleed.

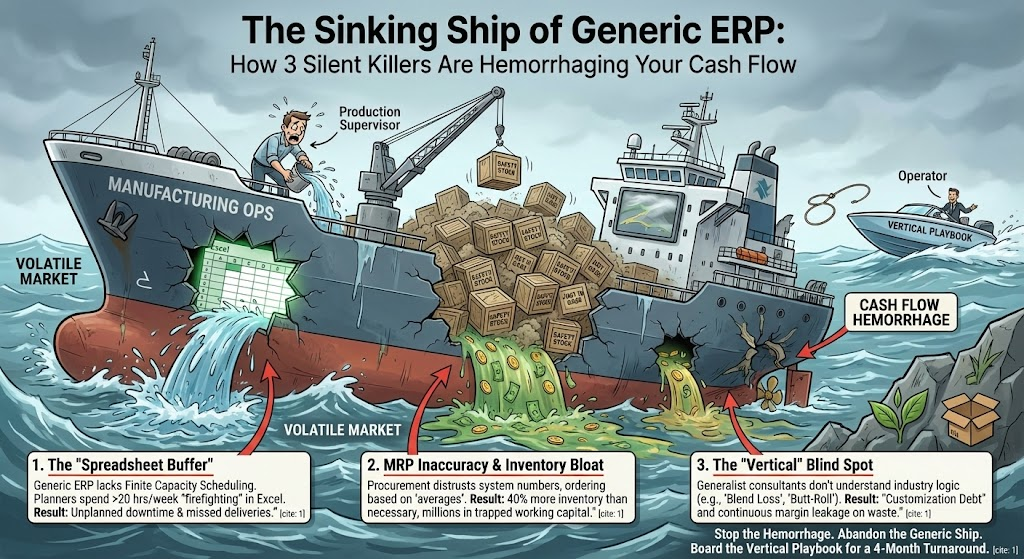

Below are the three silent killers that show up both in the factory—and in the search bar.

Silent Killer #1: The “Spreadsheet Buffer”

Search intent: “production planning in Excel vs ERP” / “scheduling conflict resolution”

What you see: You paid for a Tier-1 ERP. Then you walk onto the floor and planning is still happening in Excel.

Why it happens: Generic ERPs often don’t reflect real-world constraints the floor cares about:

- finite capacity (line limits, shift patterns)

- tooling availability (die-cutter constraints)

- maintenance downtime reality

What it costs: Your planner burns 20+ hours/week rescheduling and reconciling. Then the real cost hits:

- unplanned downtime

- missed delivery dates

- expediting freight

- penalty clauses

- reputation damage

CFO takeaway: If planning happens in Excel, your ERP is just a typewriter.

Silent Killer #2: MRP inaccuracy → inventory bloat

Search intent: “why is MRP always wrong” / “inventory variance causes”

What you see: Procurement doesn’t trust system numbers, so they over-order “just in case.”

Why it happens: Generic MRP runs on averages:

- average lead times

- average scrap and yield

- average supplier reliability

In 2026, “average” is a fantasy. Volatility punishes averages.

What it costs: Inventory becomes a cash trap. Many manufacturers respond to uncertainty by carrying materially higher safety stock than needed—because stockouts are worse than slow-moving inventory.

CFO takeaway: Inventory is not safety. It’s frozen cash.

Silent Killer #3: The “Vertical” blind spot

Search intent: “tea blending loss calculation” / “corrugated waste tracking”

What you see: Generalist consultants spend months “discovering” your workflows.

Why it happens: Generic systems treat manufacturing like a generic assembly line. But your margin is made or lost in vertical details:

- blend gain/loss logic (tea, food, chemicals)

- reel/butt-roll consumption and waste (packaging)

- yield variance tracking and grading logic

What it costs: You pay customization debt:

- consulting fees to build logic that should be standard in your vertical

- delayed go-live because basics aren’t native

- margin leakage because waste is invisible

CFO takeaway: You’re paying consultants to learn your factory on your balance sheet.

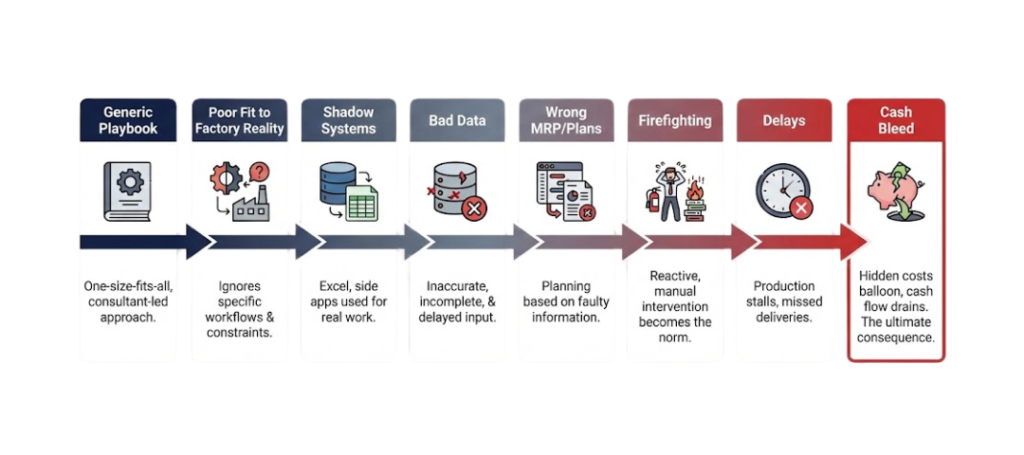

Root cause analysis: generic ERP is built for stable markets

Most enterprise ERP playbooks assume:

- predictable supply chains

- stable labor availability

- minimal disruption during go-live

- long implementation windows are acceptable

That model collapses in emerging-market manufacturing because cash flow and continuity matter more than perfect configuration.

Pentagon’s DNA is built around that reality: speed is not convenience—it’s risk mitigation. Every month you extend implementation is another month of burn, distraction, resistance, and hidden cost.

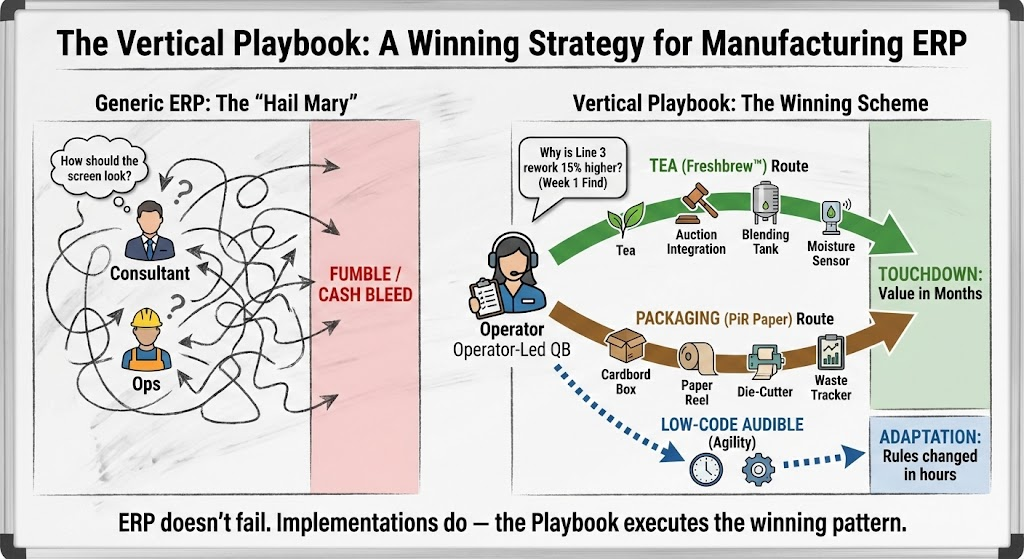

The solution: the Vertical Playbook strategy

To stop the hemorrhage, you don’t need “more features.”

You need a delivery model that prevents the failure patterns above.

Pentagon competes in one category:

Manufacturing ERP implementation specialists for unstable markets.

A Vertical Playbook is a pre-built, repeatable implementation strategy that ships outcomes fast because it’s already learned the hard parts.

1) Operator-led, not consultant-led

This is not cosmetic. It changes what happens in week one.

Consultants ask: “How do you want the screen to look?”

Operators ask: “Why is Line 3 running higher rework than Line 1?”

Pentagon’s model is built around execution and adoption—because adoption is the real go-live.

2) Industry-specific logic (pre-built, not discovered)

Pentagon only enters a vertical when it has a repeatable playbook—because vertical specialization is execution superiority, not marketing.

Examples (as you outlined):

- Tea (Freshbrew™): auction catalog integration, blending sheets, moisture loss and grading logic

- Packaging (PiR Paper): reel management, die-cut handling, actual substrate consumption tracking

3) Low-code agility (for the skeptical board)

Executives ask a fair question: “Is low-code enterprise-ready?”

The real question is: can your system change at the pace volatility demands?

Pentagon’s implementation intelligence is tool-agnostic, but its delivery advantage is tied to compressing timelines and adapting workflows fast—because delays are where cash bleeds.

The CFO business case: 4 months vs. 14 months

This is not “IT spend.” It’s liquidity.

| Metric | Generic ERP (Consultant-led) | Vertical Playbook (Operator-led) |

|---|---|---|

| Time to go-live | 12–18 months | ~4 months (target) |

| Planning reality | Excel buffers persist | Floor constraints embedded |

| Inventory behavior | Safety-stock bloat | Demand-driven reduction targets |

| Cash flow profile | Negative for extended period | Earlier operational lift |

| Adaptability | Rigid, expensive changes | Faster workflow adjustment |

The point: Short implementations reduce risk. They also reduce the time window where adoption can fail silently.

Practical next steps: how to evaluate your implementation risk

Use this as an internal board/steerco audit.

- Shadow planning test: Are planners spending 20+ hours/week in Excel?

- Trust test: Do procurement teams treat MRP as “suggestions” and buy outside the system?

- Vertical proof test: Can your partner show your vertical workflows now (reel management, blending loss, yield tracking)?

- Timeline discipline test: Is your go-live target under 6 months—or already drifting to 12+?

- Adoption ownership test: Who is accountable for adoption—vendor, consultants, or your operators?

If you fail 2+ of these, you’re not “behind.” You’re exposed.

FAQ (AEO-ready)

1) How long does a typical ERP implementation take in manufacturing?

Traditional implementations often run 12–18 months, especially with heavy process discovery and customization. Pentagon’s positioning emphasizes compressing timelines because long implementations create sustained cash burn and adoption risk.

2) Why do ERP projects fail even when the software is good?

Because failure is usually adoption + workflow mismatch, not features. If teams keep running the factory in spreadsheets and side systems, the ERP becomes a reporting tool—not an operating system.

3) What’s the biggest early warning sign of implementation failure?

The “double-entry pattern”: people update ERP for management visibility but run operations elsewhere (Excel, WhatsApp, paper). That’s adoption failure in progress.

4) Is vertical-specific ERP logic really necessary?

Yes—because margin leakage often lives in vertical details: yield loss, waste tracking, reel consumption, blending gain/loss, grading logic. If the system can’t represent those realities, you’ll pay for customizations and still miss true cost.

5) What does “operator-led implementation” actually change?

It changes the diagnostic lens. Operator-led delivery focuses on real constraints, adoption sequencing, and production continuity—not just documentation and configuration.

6) What should the board ask an ERP partner in the first meeting?

“Show me the vertical workflows right now.” If the answer is “we can build that,” you’re about to fund their learning curve.

Conclusion: don’t buy software—buy resilience

The manufacturers who survive 2026 won’t be the ones with the most features.

They’ll be the ones who close their data loops the fastest—without breaking the floor while they do it.

Board recommendations:

- Audit firefighting time. Excel dependency is not “normal.” It’s failure.

- Challenge the vendor with vertical proof, not promises.

- Commit to speed. A slow go-live is a cash flow risk masquerading as a project plan.

Stop the haemorrhage. Switch to the playbook.

Ready to secure your operations? Contact Pentagon IT Runway for a specialized diagnostic of your vertical.